Investment Trust Dividends

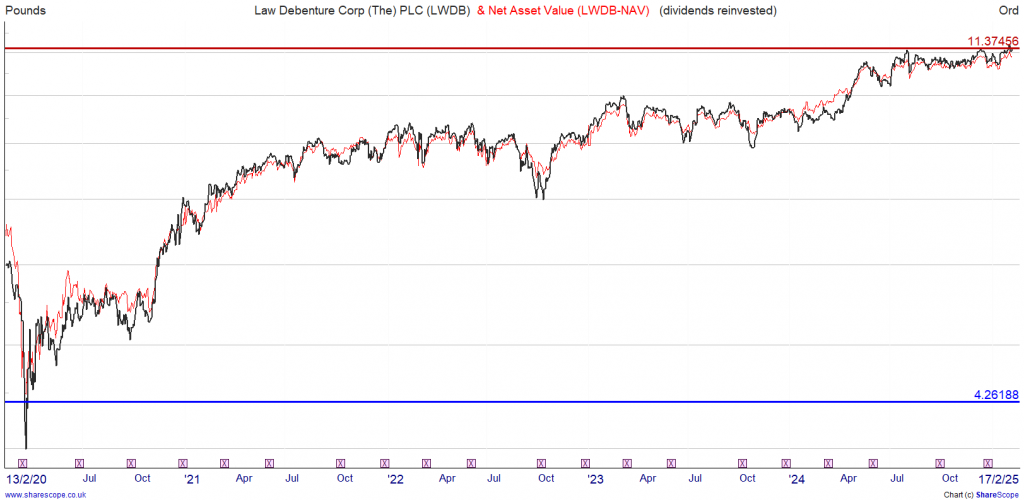

You may not have enough funds to follow WB and have a meaningful stake in Coca Cola but if what if we use LWDB as the working example, this time without dividends re-invested.

If you bought at 182p, six years later you are back to the beginning, thankfully you have dividends to re-invest, wherever you think best, it could be back into LWDB as the price fell.

Your buying yield was 3.4%, which has risen to a buying yield of 17.5% on 2k capital

If you bought 1098 shares for 2k, they would be worth today £9,936.00 plus dividends or £14,087 including dividends.

The current dividend is 32p so on the current value of £9,936.00 a running yield of 3.5% (1098 shares at 32p = £351.36)

If you intend to retire on your dividend stream, you could always re-invest part in higher yielding Trusts.

Story by Tom Stevenson

Albert Einstein called compounding the eighth wonder of the world. The famous economist John Maynard Keynes marvelled at ‘the awesome power of compound interest’.

Compounding is the addition, repeatedly, of interest to the principal of a deposit or a loan. It describes what happens when you earn interest on both the money you have initially put aside plus the interest you have already earned on that starting amount. Here’s how it works.

Imagine you save £100 in a bank account and you earn 10 per cent interest on that money (I know, it’s been many years since this has actually happened but bear with the illustration).

After one year your account will hold £110 (£10 of interest plus £100 capital, or 0.1 x 100 = £10 + £100).

Start saving young: Are you Prudence or Extravaganza when it comes to handling your finances? Find out below…

Now imagine that you leave the accumulated capital in the account and it again earns 10 per cent interest. By the end of the second year you will have £121 (£11 of interest plus £110 of starting capital, or 0.1 x 110 = £11 + £110).

See how the amount of interest grows because the same percentage is applied to a greater starting amount.

Do this year after year for, say, 20 or 30 years and something magical happens.

The numbers start to grow exponentially so that after a while the amount of interest you earn begins to dwarf the initial amount that you were able to save. The important factor here is time. It is the key component of compounding and the reason why everyone should start to save as soon as they can – preferably several years ago!

Tom Stevenson is investment director at Fidelity International.

I like to tell the story of two sisters. One starts putting aside a modest amount when she is just 18 years old.

She’s called Prudence, obviously. Saving £20 a week gives her £1,000 a year.

By the time Prudence is 38 she has accumulated £63,000 and now the extra £1,000 a year of saving starts to become irrelevant.

What matters now is the compounding of the 10 per cent growth and interest on the ever rising amount of her savings. By the time she is 60, she has accumulated a little over £500,000 even if she stops saving completely at the age of 38.

Now Prudence’s sister (I call her Extravaganza for obvious reasons) laughs at her careful sister and spends the 20 years from 18 to 38 enjoying herself and spending all her money. She’s not alone; for most of us there are plenty of other calls on our money in our 20s and 30s.

But aged 38 she sees how much Prudence has put aside and she thinks she would like to match her. She too starts saving £20 a week and earns the same 10 per cent as her sister.

But here’s the rub. Because she starts later and doesn’t benefit from the miraculous ingredient of time, she never catches her sister up.

When they are both 60, Extravaganza has accumulated just £80,000 compared with her sister’s half a million. And with every year that passes their fortunes diverge even further. (See how the sisters’ fortunes diverge in more detail below.)

It’s helpful to learn how to work out compound interest for yourself. But once you’ve grasped the essentials, there’s no need to go through this laborious process every time, writes This is Money.

Our monthly and lump sum saving and investing calculator does the task for you.

Our calculator assumes interest is calculated and compounded monthly.

But you can find other online calculators that do it annually, as in the example above.

So compounding is a powerful force. How do you work out how it might work for you ? Fortunately, there is a very simple rule of thumb to help you calculate compound interest. It’s called the Rule of 72. This is how it works.

Take the interest rate you expect to earn and divide it into 72 – the answer is the number of years it will take you to double your money. So at 6 per cent a year it will take you 12 years to double your money. A 3 per cent return will take 24 years. At 12 per cent it will only take six years.

One last point. Compounding works in reverse too. If rather than applying an interest rate to a deposit you are applying compound interest to a loan without either paying down the capital or servicing the interest, the amount outstanding will grow and grow.

Even though Prudence saves for 20 years and Extravanganza for 30, Prudence still ends up with considerably more by the time they reach the age of 68

££££££££££££££££££

Albert Einstein called compounding the eighth wonder of the world, or he didn’t.

By Keith Speights – Jan 25, 2025

Key Points

The late Senator Everett Dirksen once reportedly said, “A billion here, a billion there, and pretty soon you’re talking about real money.” With that quote in mind, Warren Buffett’s dividend income this year will be real money.

Technically, the dividend income will belong to Berkshire Hathaway. But for many, Buffett and Berkshire are practically synonymous. And they could make over $3 billion in dividend income in 2025 from these five stocks.

Buffett seems to have soured somewhat on Bank of America (BAC 1.34%). He significantly reduced Berkshire’s stake in the big bank last year. However, Bank of America (BofA) still contributes a lot of cash to the conglomerate’s coffers.

NYSE: BAC

Bank of America

As of Sept. 30, 2024, Berkshire owned 766,305,462 shares of BofA. With the company’s forward dividend of $1.04, that translates to nearly $797 million in dividend income this year. Of course, if Buffett sells more of this stock, the amount of dividends received will be lower.

The Coca-Cola Company (KO 0.38%) is one of Buffett’s “forever stocks.” He’s held it the longest of any other stock in Berkshire’s portfolio. In his 2022 letter to Berkshire Hathaway shareholders, Buffett wrote, “The cash dividend we received from Coke in 1994 was $75 million. By 2022, the dividend had increased to $704 million.” That total should be even greater this year.

Berkshire has owned 400 million shares of Coca-Cola for a long time. Coke pays a forward dividend of $1.94. If Buffett doesn’t sell any shares (which seems to be a safe assumption), Berkshire will rake in at least $776 million in dividend income from the big food and beverage company this year. The amount will likely be higher, though. Coca-Cola is a Dividend King with 62 consecutive years of dividend increases. I fully expect the company will keep that streak going in 2025.

Chevron (CVX -0.71%) is a more recent addition to Berkshire’s portfolio. Buffett initiated a stake in the giant oil and gas producer in 2020 when its shares were beaten down due to the impact of the COVID-19 pandemic.

NYSE: CVX

Chevron

Berkshire owned 118,610,534 shares of Chevron at the end of the third quarter of 2024. With the company’s dividend of $6.52, the conglomerate should make at least $773.3 million in dividend income this year. Again, though, the actual total will likely be higher. Chevron has increased its dividend for 37 consecutive years and could boost its payout soon.

Buffett wrote to Berkshire Hathaway shareholders last year that American Express (AXP -0.12%) would “almost certainly” increase its dividends in 2024 by around 16%. He was close. Amex increased its dividend payout by nearly 17%.

The legendary investor also wrote that Berkshire would “most certainly leave our holdings untouched throughout the year.” I suspect it will do the same in 2025. If so, Berkshire’s 151,610,700 shares of American Express with the financial services company’s dividend of $2.80 will add up to at least $424.5 million in dividend income this year.

Apple (AAPL 0.32%) isn’t the apple of Buffett’s eye that it once was. His position in the consumer tech giant is much lower now than it was a couple of years ago. However, Apple remains Berkshire’s largest holding. It’s also still an important source of dividend income.

NASDAQ: AAPL

Apple

The math with Apple is easy. Berkshire owned 300 million shares as of Sept. 30, 2024. With a dividend of $1 per share, that translates to $300 million in dividend income for Buffett and his company in 2025. This amount will change if Apple increases its dividend (which is likely) or Buffett sells more of the stock (which could happen).

Which is the best stock of the five for income investors?

The expected dividend income for Buffett and Berkshire from these five stocks in 2025 totals $3.07 billion. Which is the best pick for income investors?

I think income investors who aren’t billionaires will find several of Buffett’s major income producers attractive picks. Coca-Cola offers an especially impressive dividend track record along with a solid forward dividend yield of 3.14%.

However, my vote goes to Chevron as the best stock of the five for income investors. The oil and gas company has the highest dividend yield of the group (4.17%). It has also reliably increased its dividend.

£££££££££££££££

Remember compounding dividends takes a while to start to build but the sooner you start the nearer you will be to your finish.

The Renewables Infrastructure Group Limited

Interim Dividend

The Renewables Infrastructure Group Limited (the “Company”) is pleased to announce the fourth quarterly interim dividend in respect of the three month period to 31 December 2024 of 1.8675 pence per ordinary share (the “Q4 Dividend”). The shares will go ex-dividend on 13 February 2025 and the Q4 Dividend will be paid on 31 March 2025 to shareholders on the register as at the close of business on 14 February 2025.

In accordance with the terms and conditions of the Scrip Dividend Alternative and the Directors’ power to cancel the Scrip Dividend Alternative where a change in market conditions might, in the reasonable opinion of the Directors, render the Scrip Dividend Alternative materially detrimental to those Shareholders electing for it, the Board has decided to cancel the Scrip Dividend Alternative in respect of the Q4 Dividend due to the Company’s Ordinary Shares currently trading at a larger than 10% discount to the published Net Asset Value (“NAV”). Accordingly, Shareholders will receive the Q4 Dividend in cash and, should they so wish, can choose to apply the cash dividend in acquiring Ordinary Shares in the secondary market.

Young black colleagues high-fiving each other at work© Provided by The Motley Fool

Cliff D’Arcy

As I get older, I get very enthusiastic about passive income — the earnings I accrue outside of paid work.

I have many options for grabbing these earnings, but find some rather unappealing. Here are five leading forms of extra income that I’m currently considering.

Perhaps the most straightforward and widely used passive income. I simply deposit money in a high-yield savings accounts and collect the interest. With the Bank of England’s base rate at 5.25%, table-topping savings accounts pay 5%+ a year, before tax.

However, I’ve met very few people who got rich solely by keeping their money in banks. Also, the taxman takes a chunk of my savings interest, so I’m not mad keen on this route.

My second option could be to buy bonds — IOUs issued by governments, companies and other organisations. These pay me interest in the form of ‘coupons’, then later return my initial investment when they mature.

However, some bonds (say UK Gilts and US Treasurys) are safer than others, while struggling companies sometimes default on their bond payments. Perhaps I’d be better off investing in a broad-based, diversified bond fund ? This is something I’m actively considering right now.

My third choice might be to become a buy-to-let (BTL) landlord, buying houses or flats and then renting them out to tenants. In my experience as a former tenant, this can be hard work at times. Hence, I’m reluctant to become a ‘BTL baron’ later in life.

An easier alternative is the government’s ‘Rent a Room Scheme’, which lets me earn up to £7,500 tax-free each tax year by letting out a room in my own home. However, I’m sure my wife wouldn’t agree to this, so I’ll also reject this.

In 37 years of work, I have amassed a jumbled collection of various personal, company and state pensions. As I have reached 55, I could access these pots for income or lump sums. But I think it’s too early for me to do this yet, so I will leave them alone for now.

Cash dividends from stocks and shares are by far my favourite form of passive income. Though these payments are not guaranteed, dividends are my family’s second-largest income (after paid work).

For example, my wife and I own shares in FTSE 100 firm Legal & General Group (LSE: LGEN) as part of our family portfolio. While previously working in the insurance and investment world for many years, I became an admirer of this long-established company, its sound business model and solid management.

At the current share price of 242.8p, L&G is valued at £14.5bn, making it a Footsie stalwart. However, its shares are down 2.5% over one year and 12.4% over five, excluding dividends.

Share-price falls have lifted L&G’s dividend yield to a tidy 8.4% a year — almost twice the FTSE 100’s yearly cash yield of 4%. This high (and steadily rising) income is my #1 reason for owning this stock.

Then again, with £1.3trn of client assets under management, L&G shares can and do fall when share prices drop, as happened in Covid-hit 2020. And like all stock, its price can be volatile. Still, we are holding these shares for the long run!

The post 5 ideas for passive income while I sleep appeared first on The Motley Fool UK.

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Cliff D’Arcy has an economic interest in Legal & General Group shares. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

££££££££££££££££

Warren Buffett’s famous quote is: “If you don’t find a way to make money while you sleep, you will work until you die.” This emphasizes the importance of creating passive income streams to achieve financial freedom. Buffett believes that investing in assets that generate income on their own, such as stocks or real estate, is the key to building wealth over time.

Property, if you don’t have enough funds to for a buy to let property deposit another alternative is to buy Investment Trust REIT’s, with less hassle but more risk.

One Trust that owned rental properties was PRS Reit, which is up for sale but still trades at a discount to NAV but as always best to DYOR.

GRS

A simple strategy would be to re-invest your dividends back into the Trust.

When you have achieved the holy grail of investing in that you double your money, you take out your stake and re-invest in another high yielder.

I will use NESF as the working example but as always best to DYOR, a blended yield of 17%, an investment of 10k would be yielding 17% on your initial stake, (£1,700 plus) which you should receive as long as the Trusts stay in business or don’t change their dividend policy. All you need to do to monitor your Snowball, is to check the latest dividend announcement from the company. There are various web sites that allow you to do this, if you don’t have your own share monitor.

You do not need to take big risks to secure a healthy retirement.

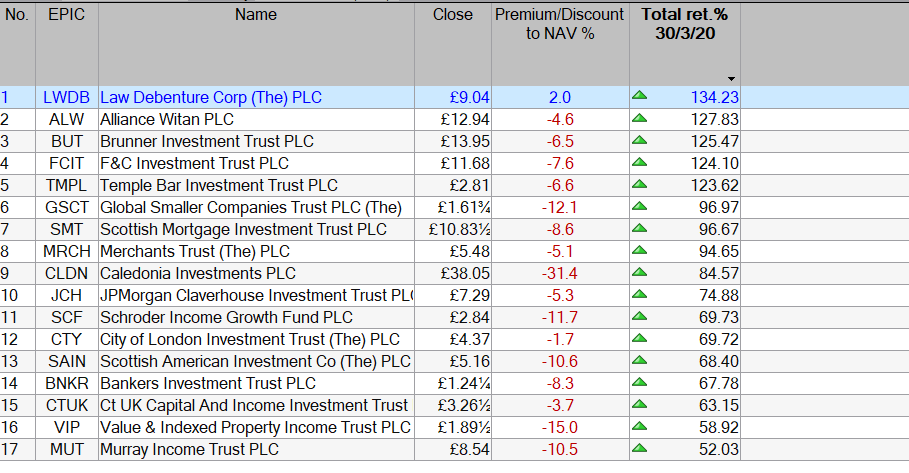

If you had done your own research and bought when everyone else was selling, the worst that could have happened was that you earned enhanced dividends to re-invest at great prices. The next market crash is just around the next corner, it’s a given, although when the corner will be is the unknown. One trading strategy would be invest part of your dividend stream in a cash fund or a gilt, so u have funds when it happens. You may not buy at the bottom but if you are happy with the yield, it lessens the risk.

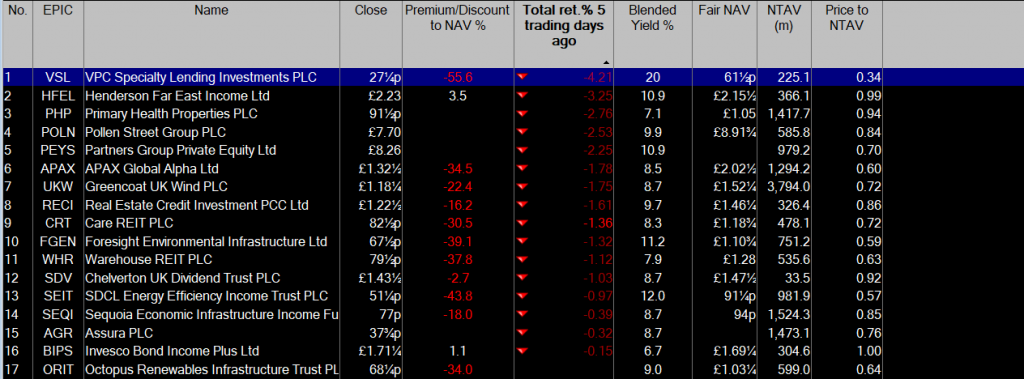

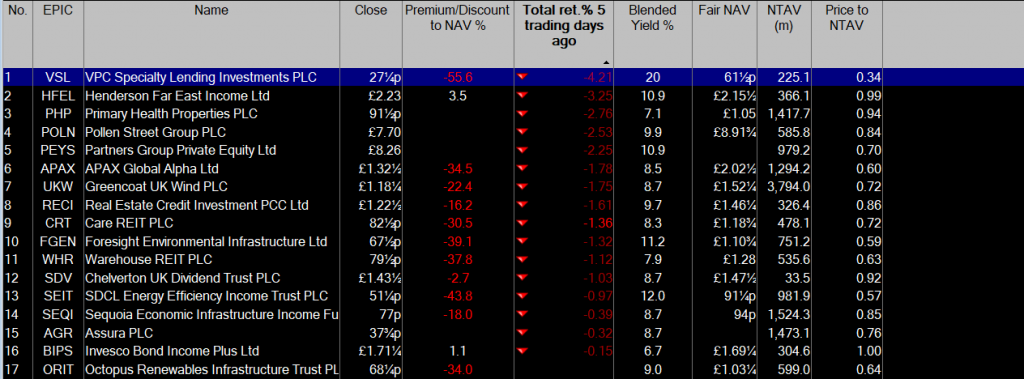

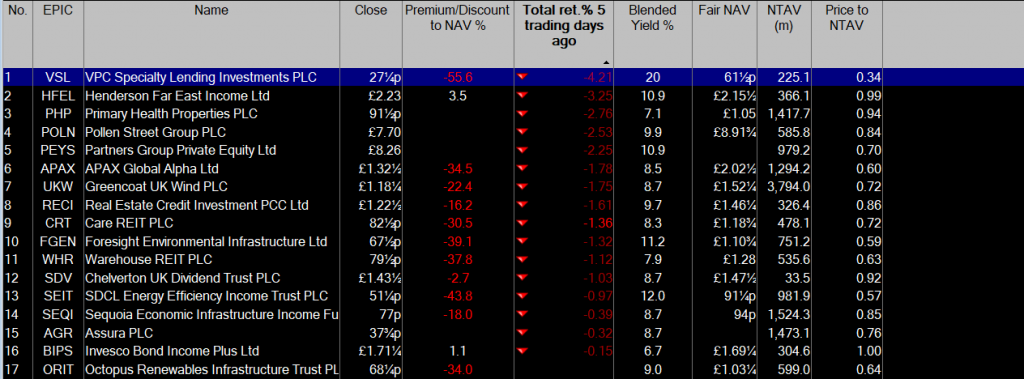

Note 8 funds have nearly achieved the holy grail of investing, where you can take out your stake, have an investment that pays you a dividend at zero, zilch, cost.

Remember compound interest takes time to build, you should make more money in you last few years of investing than in all the early years, that’s why life-styling is such a bad idea.

The worst aspect of a dividend investment plan is that you start to wish you life away as you await the next dividend to re-invest it, of course that aspect disappears when you start to spend your hard earned.

Stick to your task until it sticks to you.

NextEnergy Solar Fund Limited

(“NESF” or the “Company”)

Third Interim Dividend Declaration

NextEnergy Solar Fund, a leading specialist investor in solar energy and energy storage, is pleased to announce its third interim dividend of 2.11 pence per Ordinary Share for the quarter ended 31 December 2024.

The third interim dividend of 2.11 pence per Ordinary Share will be paid on 31 March 2025 to Ordinary Shareholders on the register as at the close of business on 14 February 2025. The ex-dividend date is 13 February 2025.

The Board is pleased to reaffirm its full-year dividend target guidance of 8.43 pence per Ordinary Share for the financial year ending 31 March 2025, where the full-year dividend target is forecast to be covered in a range of 1.1x – 1.3x by earnings post-debt amortisation.

© 2026 Passive Income Live

Theme by Anders Noren — Up ↑