Dunedin Income Fund

11 December 2025

Third Interim Dividend

· Third interim dividend of 4.25p per share.

· Total dividend for the year to 31 January 2026 of at least 19.10p per share, representing an increase of 34.5% compared to the previous year.

· Notional dividend yield of 6.0% on NAV and a share price dividend yield of 6.4%.

On 9 September 2025, the Board announced that it would significantly increase dividend distributions to shareholders and, for the year ending 31 January 2026, the Board has already stated its intention that the Company’s dividend will be increased to a minimum of 6.0% of the NAV as at 31 July 2025, offering an attractive yield compared to cash, the FTSE All-Share Index and peers in the UK Equity Income sector. This amounts to a total dividend for the year of at least 19.10p per share, an increase of 34.5% compared to the total dividend of 14.20p for the year ended 31 January 2025. Based on the share price of 297.0p as at 10 December 2025, this represents a notional dividend yield of 6.4%.

A first interim dividend in respect of the year ending 31 January 2026, of 3.20p per share, was paid on 29 August 2025 and a second interim dividend of 4.25p per share was paid on 28 November 2025.

The Board has today declared a third interim dividend in respect of the year ending 31 January 2026, of 4.25p per share, which will be payable on 27 February 2026 to shareholders on the register on 6 February 2026 with an ex-dividend date 5 February 2026.

The remaining dividend for the financial year is expected to comprise a final dividend of at least 7.40p per share payable in May 2026. A formal dividend announcement will be made in advance of this payment.

It is the Board’s intention to continue with a progressive dividend policy with growth in absolute terms in future years from the increased level, and for future financial years the Board anticipates three equal interim dividend payments followed by a balancing final dividend.

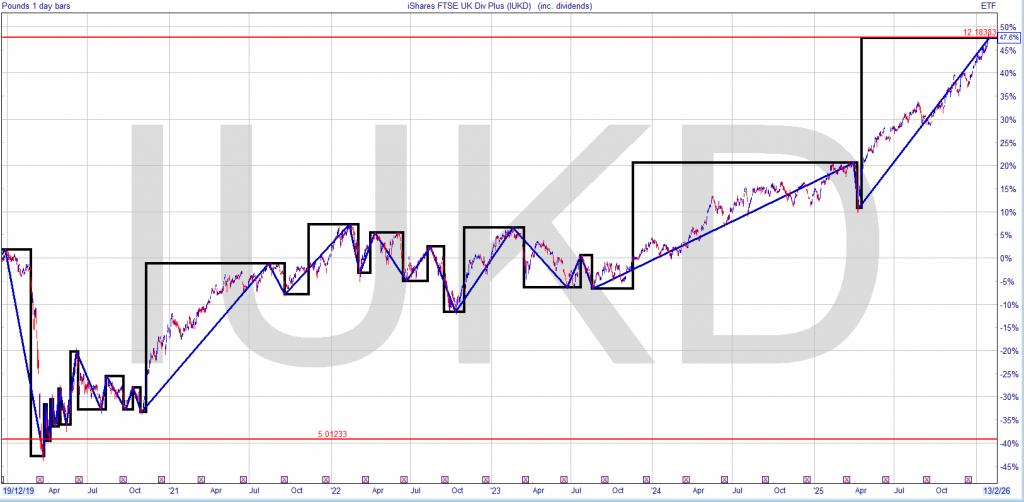

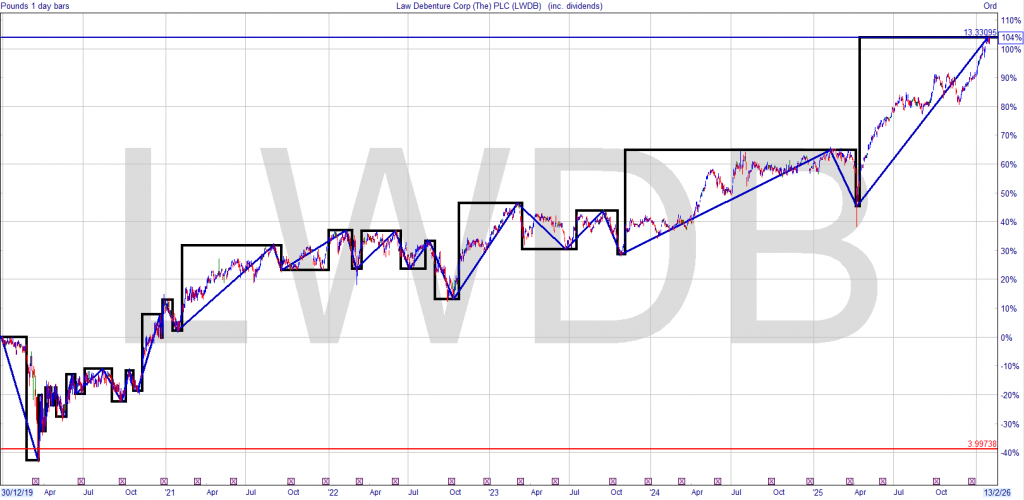

You may be thinking of adding DIG to your Snowball.

If you buy before the xd date, you will earn the dividend of 4.25p, with the final dividend being 7.4p. You could receive another 3 dividends of 4.25p in just over a calendar year, total a yield of around 8%. If the share has made a capital gain you could flip it and buy another high yielder of continue to hold for its dividend.