Regional REIT Limited

(“Regional REIT”, the “Group” or the “Company”)

2024 Half Year Results, Q2 Dividend Declaration

& £110.5m Fundraise Successfully Completed Post Period End

Regional REIT (LSE: RGL), the regional commercial property specialist today announces its half year results for the six months ended 30 June 2024.

Post-Period end highlights, Transformational Successful Fundraise:

· 18 July 2024 successfully completed £110.5m equity fund raise, supported by Shareholders

· Proceeds used for the repayment of the £50m retail bond and £26.3m will be used to reduce bank facilities. The remaining net proceeds of £28.4m will be used in accretive capital expenditure projects on assets, enhancing earnings in the near term and value in the mid to long-term, further underpinning dividend payments going forward

· 29 July 2024 1 for every 10 ordinary share consolidation completed

· 6 August 2024 repaid in full the 4.50%, £50m retail bond

· LTV reduced to 42.2% from 30 June 2024 58.3%

Financial Highlights:

· Portfolio valuation of £647.9m (31 December 2023: £700.7m). On a like-for-like basis, the portfolio value reduced by 5.1% during the period, after adjusting for disposals and capital expenditure, comparing favourably against the MSCI Rest of UK offices Index return of -6.4%

· Rent collection remained strong over the period at 98.0% (equivalent period for 30 June 2023: 98.8%).

· Rent roll at £63.5m, 3% lower on a like-for-like basis (31 December 2023: £67.8m)

· Net initial yield on the portfolio 6.1% (31 December 2023: 6.2%)

· Covered dividend declared per share of Q1 2024 1.20 pence per share (“pps”); following the successful equity capital raise and 1 for 10 share consolidation the dividend for Q2 2024: 2.20pps (30 June 2023: 2.85pps)

· The fully covered dividend target for 2024 for H2 2024 is 4.4pps

· The Group’s weighted average cost of debt continued to remain low at 3.5% (31 December 2023: 3.5%)

· Operating profit before gains and losses on property assets and other investments for the six months ending 30 June 2024 amounted to £19.1m (30 June 2023: £20.6m)

· The weighted average maturity of the bank debt was 3.0 years (31 December 2023: 3.5 years)

· EPRA NTA 48.8pps (31 December 2023: 56.4pps); IFRS NAV of 51.7pps (31 December 2023: 59.3pps)

· Prior to the 1 for 10 share consolidation on 29 July 2024: EPRA EPS of 2.1pps for the period (30 June 2023: 2.5pps); and post share consolidation 21.3p (30 June 2023: 24.6p)

Operational highlights:

· As at 30 June 2024, 81.8% of portfolio properties had attained an EPC rating of C+ or higher, an improvement from 73.7% as recorded on 31 December 2023. Properties rated B+ and Exempt have surged to 56.3%, up from 42.1% at the end of the previous year. These milestones place us firmly on the path to better the Minimum Energy Efficiency Standard (MEES) target of an EPC rating of B well before the 2030 deadline

· The Group made disposals amounting to £21.9m (before costs) during the period

· At period end, 91.5% (31 December 2023 92.1%) of the portfolio by valuation was offices, 3.4% industrial (31 December 2023: 3.2%), 3.1% retail (31 December 2023 3.1%) and 1.9% other (31 December 2023: 1.7%)

· At the period end, the portfolio valuation split by region was as follows: England 77.5% (31 December 2023: 78.4%), 16.7% Scotland (31 December 2023: 16.2%) and 5.8% Wales (31 December 2023: 5.4%).

· By income, office assets accounted for 90.9% of gross rental income (30 June 2023: 91.4%) and 4.3% was retail (30 June 2023: 4.6%). The remaining balance was made up of industrial, 3.0% (30 June 2023: 2.7%) and other, 1.8% (30 June 2023: 1.4%)

· The portfolio continues to remain diversified with 132 properties (31 December 2023: 144), 1,305 units (31 December 2023: 1,483) and 832 tenants (31 December 2023: 978)

· EPRA Occupancy rate stood at 78.0% (31 December 2023: 80.0%)

Q2 2024 Dividend Declaration

The Company declares that it will pay a dividend of 2.20 pps for the period 1 April 2024 to 30 June 2024. The entire dividend will be paid as a REIT property income distribution (“PID”).

Shareholders have the option to invest their dividend in a Dividend Reinvestment Plan (“DRIP”), and more details can be found on the Company’s website.

The key dates relating to this dividend are:

| Ex-dividend date | 19 September 2024 |

| Record date | 20 September 2024 |

| Last day for DRIP election | 27 September 2024 |

| Payment date | 18 October 2024 |

The level of future payments of dividends will be determined by the Board having regard to, among other factors, the financial position and performance of the Group at the relevant time, UK REIT requirements, the interest of shareholders and the long term future of the Company.

Stephen Inglis, CEO of London and Scottish Property Investment Management, the Asset Manager:

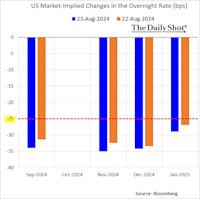

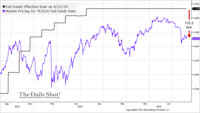

“The period under review was another challenging period for the commercial real estate sector, with valuations reduced by persistently high interest rates and poor investor sentiment towards UK commercial real estate. However, the regional office market appears to be reaching an inflection point, with the recent cut to the base rate providing a helpful development.

“Post-period end, we repaid in full our 4.50% £50m retail bond, which we were able to achieve following a £110.5m capital raise in July. This also provides us with the opportunity to reduce the Company’s borrowings with the LTV reducing to 42% and we continue to make efforts to reduce the LTV further to the long term target of 40%. The raise also provides greater flexibility for capital expenditure to improve the core assets in our portfolio and increase shareholder value going forward.

“We would again like to thank shareholders for their continued support during this challenging period and we look forward to updating them on our progress in enhancing shareholder value through active portfolio management.”

Subsequent Events summary post 30 June 2024

Since the quarter end, the Group has successfully completed an additional notable letting:

Lettings

· The Courtyard, Macclesfield – Elior UK Services Ltd. has renewed existing lease for 23,100 sq. ft. of space to August 2028, at a rental income of £542,700 pa (£23.49/ sq. ft.)

· 1175 Century Way, Thorpe Park, Leeds – Greenbelt Group Ltd. has let 2,670 sq. ft. of office space to July 2029, at a rental income of £64,080 pa (£24.00 / sq. ft.).

· Mandale Business Park, Durham – Avove Ltd. has let 5,000 sq. ft. of office space to July 2034 with the option to break in 2029, at a rental income of £58,750 pa (£11.75 / sq. ft.).

· St James Business Park, Paisley – Maximus UK Services Ltd. has let 5,456 sq. ft. of office space to September 2029 with the option to break in 2025, at a rental income of £76,384 pa (£14.00 / sq. ft.).

· Buchanan Gate, Stepps, Glasgow – RPS Environmental Management Ltd. has let 7,710 sq. ft. of office space to September 2029 with the option to break in 2027, at a rental income of £88,665 pa (£11.50 / sq. ft.).

Future asset disposal programme comprises of 54 sales totalling c £106m:

· 2 disposals contracted for c. £1.5m

· 10 disposals totalling c. £12.4m under offer and in legal due diligence

· 7 further disposals totalling c. £10.4m are in negotiation

· 7 further disposals totalling c. £9.1m are on the market

· 28 potential disposals totalling c. £73m are being prepared for the market