Story by Rupert Hargreaves

Why MoneyWeek likes investment trusts© Getty Images

The investment-trust structure was conceived in the mid-1800s to fill a gap in the market for a low-cost, mass-market investment vehicle. One of the first was Foreign & Colonial, founded by City of London financier Philip Rose. The entrepreneur had a revolutionary goal: to provide the “investor of moderate means the same advantages as the large capitalist”

In the 1800s, investing was largely the preserve of the wealthy, with limited options available to the smaller investor. Foreign & Colonial pooled investors’ money and invested it in a diversified portfolio, spreading risk across a basket of assets.

The closed-ended structure, which provided a stable pool of long-term capital, made these investment companies ideal vehicles for financing the expansion of the British Empire and the rapid industrialisation of the Americas. As global investment markets grew and diversified, the range of investment options available to investors with investment trusts expanded, and the range of trusts available also expanded.

Investment trusts have a fixed capital base

Investment trusts are structured as companies. They issue a set number of shares at the time of their flotation, and this forms a fixed capital base. Investors are then free to buy and sell the shares on an exchange. As the shares are freely traded and the asset base is fixed, trusts can trade at a premium or a discount to their underlying net asset value (NAV).

Open-ended vehicles, such as exchange-traded funds (ETFs), unit trusts and open-ended investment companies (Oeics) issue or eliminate excess shares at the end of each day to ensure the NAV and the share price match. This means there’s no room for a discount or premium to emerge.

This also means the capital base can shrink dramatically if the number of sellers consistently exceeds the number of buyers (and the price of shares in the fund falls). As the capital base shrinks, the vehicle has to continue selling assets to fund investment outflows. If those assets are challenging to sell, this can lead to a liquidity crunch. That’s why investment trusts tend to be the best vehicle for holding illiquid assets. They have no obligation to sell the assets, no matter how wide the discount to underlying NAV may become.

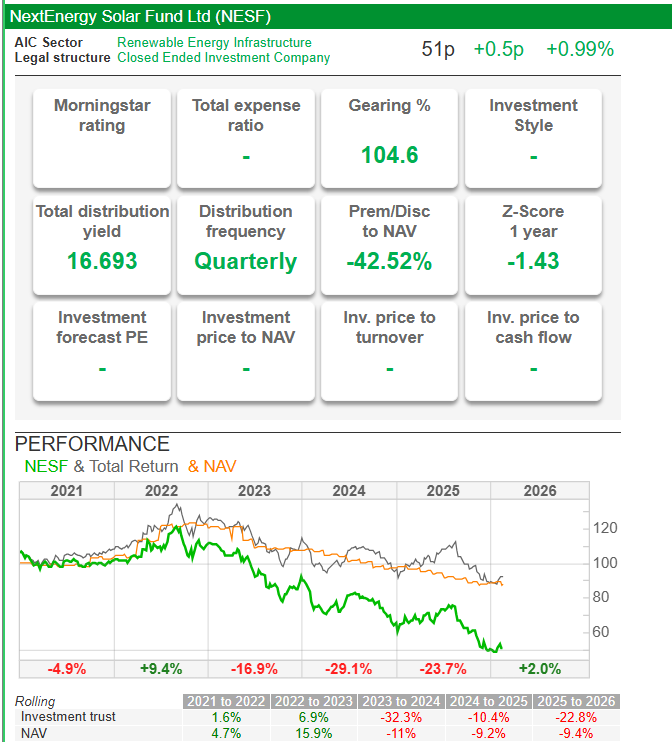

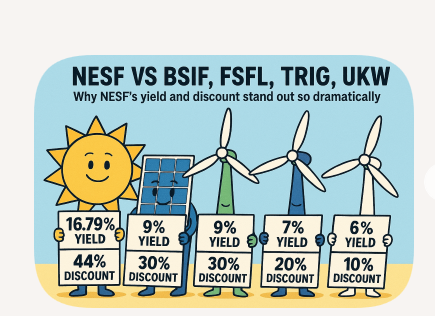

Some of the biggest trusts in illiquid sectors are the infrastructure trusts 3i Infrastructure (LSE: 3IN), Greencoat UK Wind (LSE: UKW) and the Renewables Infrastructure Group (LSE: TRIG). All of these trusts own portfolios of illiquid infrastructure assets, which generate steady inflation-linked cash flows.

Infrastructure isn’t the only asset class that lends itself well to the investment-trust structure. Trusts are ideally suited to owning portfolios of mixed assets, such as bonds, gold and stakes in hedge funds or private-equity investment funds. BH Macro (LSE: BHMU) has a position in the global macro hedge fund Brevan Howard, giving investors access to a fund that would otherwise be unavailable.

HarbourVest Global Private Equity (LSE: HVPE) is just one investment trust in the private-equity sector, offering investors exposure to this asset class via the trust structure. RIT Capital (LSE: RIT) and Caledonia (LSE: CLDN) are two examples of trusts making the most of the flexibility offered by the structure. Both are majority-owned by their founding families and own a broad portfolio of assets, from private-equity holdings to direct investments in other companies and portfolios of equities.

The structure of the investment trust also lends itself well to borrowing money. Investment trusts that specialise in acquiring illiquid assets – such as wind farms, property and infrastructure assets – can borrow against those assets to increase growth and build the asset base. These companies can also borrow to invest in equities. Borrowing money to invest in shares can be risky, but trusts can often mitigate some of the risk by issuing long-term fixed bonds.

For example, Scottish American (LSE: SAIN) issued £95 million of long-term debt between 2021 and 2022 with a blended interest rate of under 3%, maturing between 2036 and 2049. The trust, which owns a portfolio of equities, as well as property and infrastructure via other investment trusts, used the cash to reinvest into the portfolio.

The ability to borrow money is particularly helpful for the real-estate investment trust (Reit) segment of the market. Reits are a version of the typical investment trust, but with tax benefits when the majority of the portfolio is deployed into property. Companies like Supermarket Income (LSE: SUPR) and PHP (LSE: PHP) have leveraged this structure to build property portfolios designed around supermarkets and healthcare facilities, respectively.

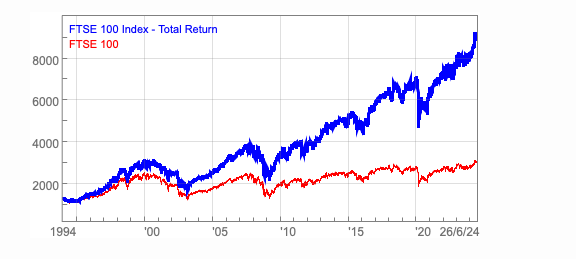

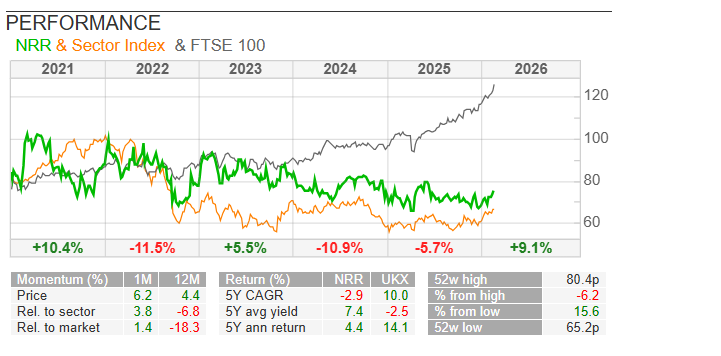

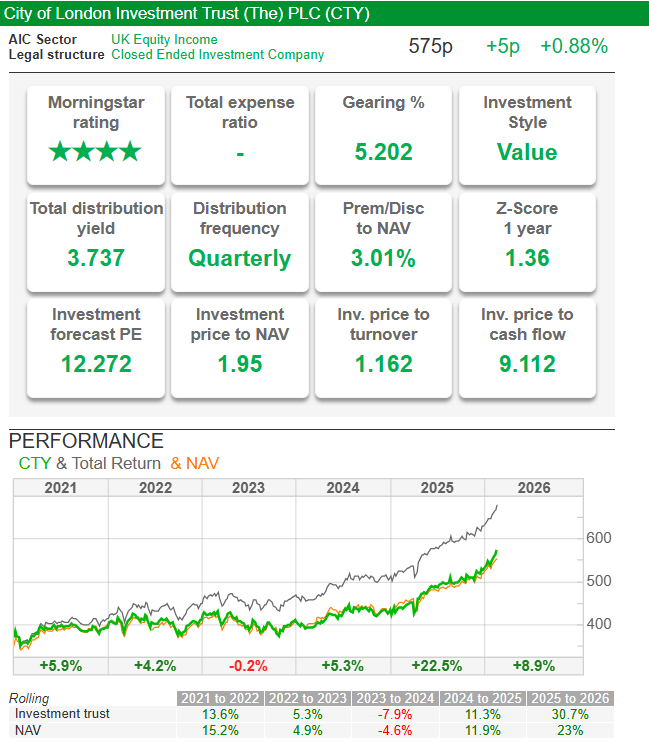

MoneyWeek has always preferred investment trusts to open-ended funds for the above reasons – and the fact that they have historically outperformed other actively managed, open-ended funds. However, this has started to change in recent years. Investment trusts, particularly in equities, have struggled to keep up with the performance of other funds. As a result, investors have drifted away, and discounts to NAVs have risen sharply.

But there’s still a place for trusts within investors’ portfolios. Thanks to the structure of trusts, they are invaluable to build exposure to specific themes such as small caps, emerging markets, property and infrastructure. There are virtually no mass-market alternatives to the infrastructure offering, and trusts such as BH Macro, RIT and Capital Gearing (LSE: CGT) offer the sort of portfolio diversification that just can’t be found elsewhere.

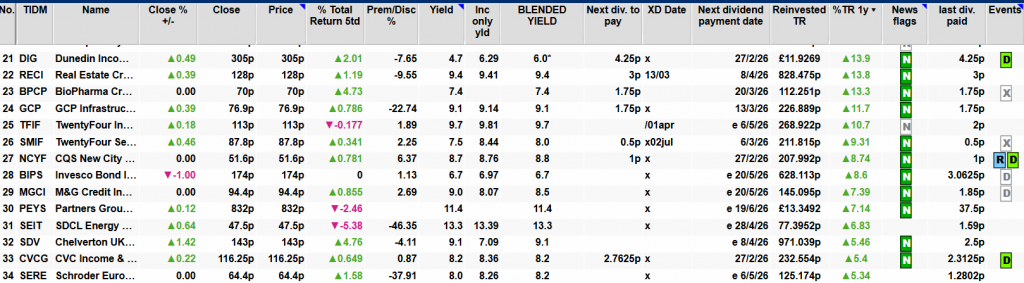

The 2026 target a yield of 10%, which in year 4 of the plan is already higher than an annuity and you get to keep all your hard earned. Remember when its gone its gone.