ISA funds around the world: eight pairings to mix and match

Faith Glasgow explains the benefits of investing in funds with contrasting styles or approaches, and asks a range of experts to name their top fund pairings for several major regions.

18th February 2026

by Faith Glasgow from interactive investor

Should you hold several funds covering the same market? Certainly, articles about diversification often warn of the dangers of stock overlap between funds, resulting in unwitting over-exposure to particular companies.

However, all markets comprise a range of businesses in terms of size, sector, and other characteristics such as growth, value, or a dividend focus – so there’s a interesting case for combining funds that adopt complementary styles or focuses to cover the same region.

Obvious pairings include growth-focused holdings with those seeking out undervalued businesses, and pairs concentrating on different market capitalisations.

Not only can such combinations provide broader (but still selective) coverage of that market, but they may respond differently to wider macroeconomic issues such as interest rate trends, inflation or US tariff imposition – giving you a more robust portfolio overall.

To give you some ideas for attractive pairings, we’ve asked some experts for their recommendations across several major regions.

Global

Global fund managers have a huge universe of stocks from which to select, making a best-ideas philosophy – where the manager does a lot of filtering and deep research – an attractive starting point. On that basis, Sheridan Admans, founder of Infundly, a UK-based investment consultancy, suggests pairing the WS Blue Whale Growth I Sterling Acc and WS Havelock Global Select A GBX Acc funds.

Although both funds take a similarly high-conviction approach, they come at it from very different starting points in regard to portfolio construction, risk exposure and sources of return.

Blue Whale Growth uses bottom-up selection processes to identify just 25 to 35 large-cap stocks from developed markets, particularly North America. It focuses on businesses with real potential to grow and become more profitable in the long term, and attractive valuations bearing that potential in mind.

“This structure gives Blue Whale strong upside participation when global growth leadership is concentrated in high-quality franchises with durable earnings and pricing power,” Admans explains – although the portfolio can be relatively volatile.

In contrast, Havelock Global Select’s 30 to 40 holdings are selected on the basis of value and quality, “where valuation, balance-sheet strength, asset backing or behavioural mispricing create attractive long-term return potential”.

There’s a bias towards mid- and smaller-cap businesses and away from the crowded mega-cap growth space, and a more even spread across the US, UK and Europe, reducing reliance on any single regional growth engine and helping to lower volatility.

The two strategies form a complementary global equity pairing, says Admans. “One is designed to capture sustained growth in dominant franchises through a concentrated large-cap portfolio; the other seeks out a concentrated set of value and quality-led ideas, exploiting mispricing and structural inefficiencies.”

Stephen Yiu, manager of Blue Whale Growth, was recently interviewed by interactive investor. You can watch the videos via the links below.

The US

At Nedgroup, multi-manager portfolio manager Madhusree Agarwal offers a markedly different approach to US investment.

Nedgroup makes strategic use of index tracking funds to deliver returns for investors, and for US coverage that includes pairing the S&P 500at market‑cap exposure with a S&P 500 Equal Weight ETF. As Agarwal observes: “On paper, they hold the same companies. In practice, they deliver very different outcomes.”

There are plenty of index fund and ETF options to gain exposure to the S&P 500 index, however the most-popular options among interactive investor customers are the accumulating and distribution versions of

Vanguard S&P 500 ETF USD Acc VUAA

and

Vanguard S&P 500 UCITS ETF GBP VUSA

Two equal weight ETF options are Invesco S&P 500 Equal Weight ETF Acc GBP SPEX

and

Xtrackers S&P 500 EW ETF 1C GBP XDWE

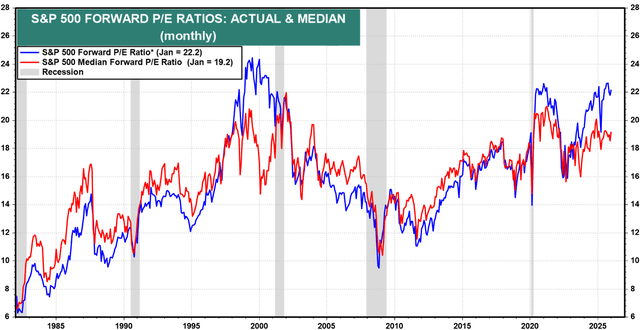

Agarwal explains that the market‑cap weighted S&P 500 “remains the most efficient way to capture long‑term US equity growth, but it naturally becomes concentrated in the biggest winners, particularly during periods when mega‑cap growth stocks dominate markets”.

As a result, investors can end up with far more concentrated exposure to a small number of names than is desirable. By pairing a standard S&P 500 ETF with an equal-weight approach counterpart, she adds, risk is spread more evenly and rebalancing takes place regularly.

In addition, Agarwal suggests complementing this large‑cap pairing with S&P 600 small‑capexposure. That further broadens the source of returns for investors, providing greater sensitivity to domestic US growth and higher use of debt to leverage returns. Options include

iShares S&P SmallCap 600 ETF USD Dist GBP ISP6

Invesco S&P SmallCap 600 ETF USML

“Importantly, the S&P 600 includes profitability screens, which improves quality relative to many broader small‑cap indices,” she notes. Rather than betting on a single style being ‘right’, “the aim is to build US equity exposure that can adapt as market leadership changes, delivering a smoother and more resilient outcome”.

The Shard, London, towers over a Union flag.

The UK

For the UK, Admans identifies two valuation-led conviction-based funds that focus on different parts of the market cap spectrum – and also different stages of the recovery cycle.

The large-cap bias of Invesco UK Opports (UK) (No Trail) (Acc) means that “its opportunity set is global in revenue terms, with many holdings generating cash flows well beyond the domestic economy,” he explains.

The managers look for companies trading at discounts to their own history and to peers, often where uncertainty, regulation or cyclical pressure has weighed on investor sentiment.

“This leads naturally to exposure to established, cash-generative franchises, particularly in areas such as financials, healthcare and consumer staples, where balance sheets and dividends provide support while valuation normalises,” he adds.

Aberforth Smaller Companies Ord

investment trust, in contrast, is firmly focused on small businesses with balance sheet strength and sustainable dividends, but “where mispricing has been both more persistent and more pronounced” than the Invesco fund.

ASC’s portfolio comprises around 80 companies, but is very much conviction-led, with “stakes of over 10% in 28 companies” and a strong focus on active engagement with management as part of the turnaround process.

As Admans points out, the pairing works because “Invesco provides exposure to UK-listed franchises that can re-rate as pessimism fades, offering income and stability while investors wait; Aberforth complements this with exposure to deeply undervalued smaller companies, where any improvement in liquidity, confidence or M&A activity can drive outsized returns.”

UK smaller companies

Meanwhile, for smaller company aficionados, Ryan Lightfoot-Aminoff, an analyst at Kepler Partners, suggests the pairing of Rockwood Strategic Ord

investment trust and IFSL Marlborough UK Micro Cap Gr P Acc fund for their contrasting style and approaches to portfolio construction.

RKW, says Lightfoot-Aminoff, has done very well through “building a highly concentrated portfolio of out-of-favour micro caps, taking sizeable stakes and helping to instigate a turnaround, with the goal of selling after around three to five years”.

The Marlborough fund, in contrast, comprises a highly diversified portfolio of around 150 of the smallest companies in the market, filtering out some parts of the economy before analyzing and picking stocks, “with a preference for growth stocks”.

The contrast in terms of concentration, active engagement and growth versus value tilts makes them a useful pairing for this rich hunting ground.

Europe

Peter Walls, manager of Unicorn Mastertrust B, a fund of investment trusts, highlights the fact that although smaller companies can outperform larger counterparts in most markets, “there are periods when they lag behind and then catch up in short order”.

Because it’s so hard to know when those reversals will occur, it particularly pays investors to be diversified across both large and small companies. In Europe, he suggests Fidelity European Trust Ord

and The European Smaller Companies Trust PLC

0.23% to cover the market-cap spectrum.

Both have well-regarded managers, but “Fidelity European has nearly all its assets invested in companies valued at more than £10 billion, while ESCT holds companies with an average market capitalisation of £1 billion and rarely strays above £3 billion”.

Another European pair

Taking a more growth/value-based tack, Ben Yearsley, an investment consultant at Fairview Investing, selects the Montanaro European Smaller Ord

fund for a fairly concentrated portfolio of small to mid-cap quality growth companies with strong balance sheets, “often in niche areas that are growing”.

He pairs that with WS Lightman European R Acc, a “proper value fund looking for cheap companies that have started to turn the corner”. Again, though, a robust balance sheet is a must.

Silhouettes of people walking in Chaoyang district, Beijing, China.

China

For effective risk-managed exposure to China’s growth story, Admans selects Jupiter China Equity Fund U1 GBP Acc, a core large-cap fund with a preference for well-established businesses.

“It aims to capture long-term earnings growth through policy-supported structural themes, such as domestic consumption, expansion of the region’s financial market, and digitalisation, while maintaining risk discipline in a volatile and politically sensitive market,” he says.

His suggested pairing is Fidelity China Special Situations Ord FCSS

which fishes in the same ocean but takes a much more idiosyncratic approach. Because FCSS is “structured as an investment trust, it has the flexibility to use gearing, take short positions, and invest selectively in less liquid or under-researched parts of the market”.

The fact it is an investment trust also gives potential for a further performance ‘kick’ when sentiment improves towards China and the discount narrows. “The pairing works because it separates core exposure from opportunistic return drivers,” Admans adds.

Japan

For effective coverage of the Japanese market, Ben Mackie, a senior fund manager at Hawksmoor Fund Managers, also combines investment trusts and funds with contrasting investment styles and market cap exposures.

His first pick is Nippon Active Value Ord NAVF

investment trust, which has a high-conviction portfolio with a small-cap focus. “The managers take significant stakes in smaller companies trading on cheap valuations and follow a strategy of active engagement that can range from constructive advice on operational matters to corporate activity,” Mackie observes.

“NAVF is one of the purest ways of playing the Japanese corporate governance reform story, while the managers’ willingness to effect change and unlock value at individual companies drives idiosyncratic returns.”

Lazard Japanese Strategic Equity EA Acc GBP is selected as a good complement. Mackie explains that while its fund managers can go down the market-cap spectrum (and recently have) the portfolio tends to have a bias to larger companies.

He adds: “Although valuation conscious and often contrarian, the portfolio is managed in a pragmatic manner resulting in balanced, style agnostic exposure to the Japanese market. Stock selection should be the main driver of returns with the high-conviction portfolio a bottom-up collection of convex positions, with a risk management overlay to ensure sensible factor and sector diversification.”

Important information: Please remember, investment values can go up or down and you could get back less than you invest. If you’re in any doubt about the suitability of a Stocks & Shares ISA, you should seek independent financial advice. The tax treatment of this product depends on your individual circumstances and may change in future. If you are uncertain about the tax treatment of the product you should contact HMRC or seek independent tax advice.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company’s or index name highlighted in the article.