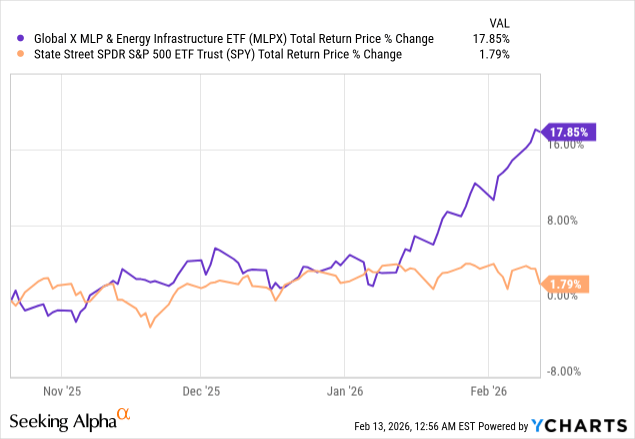

Two 9% Dividends on Sale (Up to 17% Off). Thank the Software Selloff.

Michael Foster, Investment Strategist

Updated: February 16, 2026

The recent plunge in software stocks is another reminder that AI is rattling through the economy, setting off rapid change and disruption wherever it goes.

Investors sold software stocks on fears that new AI tools will make it easier for individuals to create their own apps, potentially taking business from software developers.

This is a big change—and here’s some news that might surprise you: For income investors, it sets up another way to tap AI’s growth for dividends. We welcome that; in the early days of AI, the only real ways to get in were through low- (or no-) payers like NVIDIA (NVDA).

Just last July, research had shown that software developers actually coded more slowly when using AI tools. Now that Claude Code and updated versions of Codex from ChatGPT are rolling out—and OpenAI is promising more tools for developers soon—software is turning into something users make for themselves, rather than buy from someone else.

Investors’ focus, as a result of this development, has been on software companies, specifically how vulnerable their businesses really are to this shift. But we’re not going to focus on that today. We’re more interested in the productivity gains these new tools will unleash—and exactly what impact they’ll have on our dividends.

Productivity in Overdrive

The bottom line here is that if everyone can create software, it will result in a consumer surplus that will support the economy. That could come in the form of consumers and companies saving money on software subscriptions; building their own, personalized tools; or requiring fewer developers.

This is a compelling story for investors, and it’s another in a long line of AI innovations behind the S&P 500’s 16% gain over the last year, ahead of its 10.5% average annual return. I see above-average stock performance continuing as these new tools boost productivity and free up more cash for other spending.

But let’s pause for a moment and try to come to grips with exactly how much of a productivity boost we can expect here.

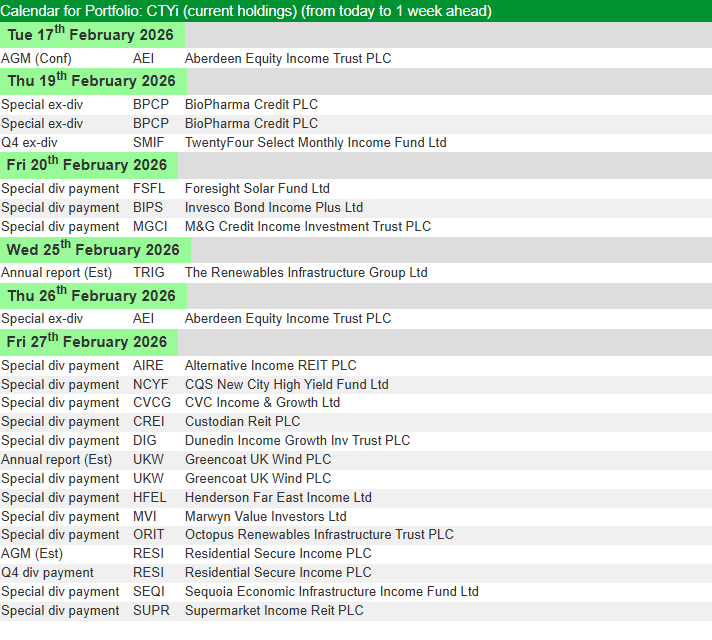

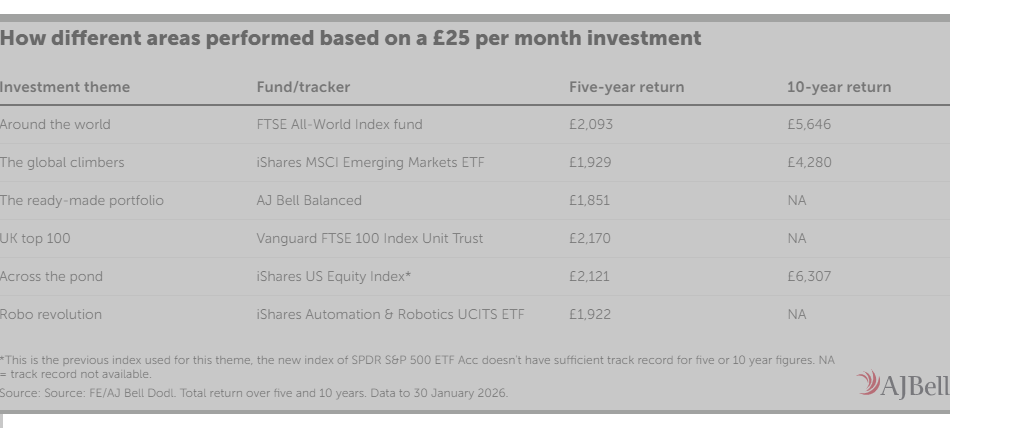

Source: METR

This is a pretty popular (and controversial) chart in the AI world. It tracks how long of a task an AI model can successfully perform. Right now, it shows that our third-best model can perform a task that would normally require 6.6 hours of human labor.

Our best models haven’t been tested yet because they were literally released in the last couple of weeks (things are happening that quickly!).

So while we do not know how much better our best models are, we do know that they are better. Time will tell. But what this really signals is that we’re past the debate of whether AI makes engineers more productive. We’re now debating how much more productive it will make them.

What’s the Dividend Play Here?

Those who hear “AI” and think “buy NVIDIA” are behind the curve (and not only due to the stock’s lame 0.02% yield!).

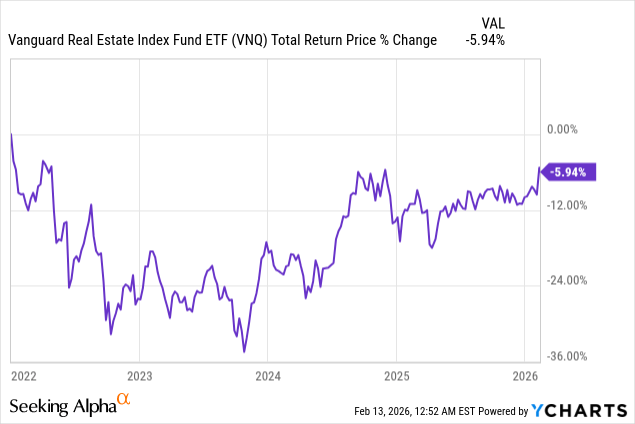

That said, we want to keep buying tech, even after the sector’s run-up in the last few years, but we want to focus on other sectors primed to benefit from AI’s strong potential, too: Utilities, for example, are well-known plays on AI’s soaring energy use, and data-center demand is likely to help real estate investment trusts (REITs).

Such a broad-based bullish story is best for income investors who are broadly invested in the market and have strong income to tide them over during micro-panics like the one that hit software stocks.

That’s why, rather than try to pick individual stocks, we look to CEFs that benefit from rising productivity across the economy.

This 9.3% Dividend Is a Smart Play on a More Productive Economy

There are a lot of high-yielding closed-end funds (CEFs) that fit that bill. One of my favorites is the Liberty All-Star Growth Fund (ASG). This fund, a holding of my CEF Insider service, yields 9.3% as I write this.

ASG isn’t exclusively a tech fund, as it holds a basket of other stocks of all sizes, including property manager FirstService (FSV) and Pennsylvania-based Ollie’s Bargain Outlet Holdings (OLLI). But it does hold NVIDIA, alongside other blue chip tech stocks like Alphabet (GOOGL), Amazon.com (AMZN), Microsoft (MSFT), Apple (AAPL) and Meta Platforms (META).

Crucially, ASG also sports a wide discount to net asset value (NAV, or the value of its underlying portfolio). That’s because conservative income investors, in response to the pullback in software stocks, have oversold this growth-oriented fund.

ASG’s “Discount Dip” Serves Up a Solid Entry Point

The result is that we can buy ASG’s diverse portfolio for around 90 cents on the dollar.

We also like ASG for its dividend policy, as it ties its payout to the performance of its portfolio. So the better the fund’s portfolio performs, the faster the payout grows—a sweet setup in an economy getting a nice productivity boost.

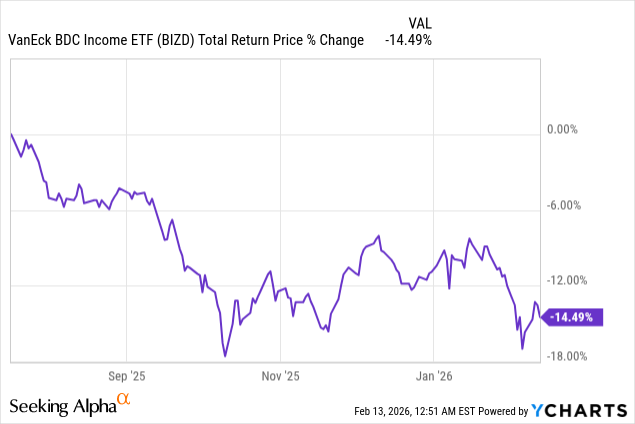

A Deep-Discounted 9.6% Payer for Aggressive Investors

Another, more speculative option is the 9.6%-yielding BlackRock Technology and Private Equity Term Trust (BTX). As the name says, it has a wide variety of high-tech companies both public and private, such as NVIDIA (NVDA), quantum-computing firm PsiQuantum, Fabrinet (FN), whose technology helps manufacturing firms improve their processes, and AI infrastructure firm Celestica (CLS).

Gains from these stocks have helped shore up the fund’s dividend, so we’re looking at more income security in the near term.

And since most CEF investors are more conservative—and thus more easily spooked by negative headlines—this fund’s discount tends to fluctuate more widely than that of the more broad-based ASG. The recent software selloff has pushed it deeper into bargain territory.

Oversold BTX Trades for 84 Cents on the Dollar

Let me leave you with the idea that there are hundreds of CEFs that are well-positioned to profit from this revolution in automation. That shift is not being priced in because markets are moving too slowly to keep up with AI. That gives us a rare opportunity to buy high-yielding funds like these, whose discounts are unusually wide in relation to their history.

My 5 Top Monthly Dividend CEFs Pay Out 60 Times a Year (and Yield 9.3%, Too)

These two are just the start. Truth is, equity CEFs focused on rising productivity are at the very heart of my “60 Paycheck Dividend Plan.”

As the name suggests, the 5 CEFs that make up this “plan” each pay dividends monthly. That’s 5 dividend payouts a month, or 60 every year! They throw off a rich 9.3% average dividend between them, too.