If 2026 Is 2008 Redux, You’ll Want to Own This 8.4% Dividend

Michael Foster, Investment Strategist

Updated: September 22, 2025

$20 trillion.

That’s how much value has been added to the US housing market in the last five years. It’s a number so big it’s near-impossible to get your head around. And it’s a double-edged sword.

On the one hand, if you own a house, that house is worth more, and you’re richer as a result. But if you don’t, buying is expensive and comes with a higher risk of a price drop. That’s because this $20-trillion gain is a 57% increase since 2020, or 9.5% per year.

That is, simply put, unsustainable.

Which is why, today, we’re going to look at a way to hedge against this risk and collect an 8.4% dividend as you do. If you don’t own a home, this is the perfect way to get into real estate—with less risk than your typical homeowner takes on!

But let’s put the stats in context first.

Over the last 30 years, housing has risen an average of 4.8% annualized, or about half of the gain since 2020.

A jump like that might make you think of the 2000s housing bubble and Great Recession. It’s only natural to worry that something like that may be around the corner.

Luckily, that’s unlikely. The causes of that crash don’t really exist anymore—we aren’t seeing zero-down mortgages, exotic dancers buying multiple homes, and negative equity piling up. Mostly this is because zero-down loans are largely a thing of the past. Moreover, mortgage rates are still elevated, which moderates homebuying.

The result is a situation where many Americans are locked into their homes (if they got a good rate in the 2010s or an amazing rate in the pandemic), can’t buy, or, if they have a home, can sell and make a strong profit—if they’re willing to downsize.

But there is a crowd that can sell property without downsizing: professional real estate investors. Here I’m talking specifically about real estate investment trusts (REITs)—and more specifically the 8%+ yielding closed-end funds (CEFs) that hold them.

REITs, of course, hold everything from warehouses to celltowers, and each individual REIT often owns dozens, hundreds or even thousands of properties.

This lets them sell properties in places where price gains have been the strongest and lock in those gains. They can then buy in places where gains have been more muted.

Or REITs can pivot to tap rising demand in other kinds of real estate. Data centers are a good example. They’re often built on cheap land and collect huge rents from the likes of Microsoft (MSFT), Oracle (ORCL) and OpenAI.

This 8.4%-Paying REIT Fund Should be Pricey, But It’s Not—Yet

When you look at the flexibility REITs have over individual homeowners, you’d think that funds holding REITs would trade at huge premiums to their true value.

But they’re not.

Consider the Nuveen Real Estate Income Fund (JRS), an 8.4%-yielder I love (it’s a holding in my CEF Insider service), but the market doesn’t share my affection.

In fact, very few other investors have ever heard of JRS, because most simply default to an ETF when investing in REITs. That’s too bad, because they’re missing out on both high yields (REIT ETFs tend to pay around 4% or less) and upside.

A big part of that upside comes in the form of CEFs’ discounts to net asset value (NAV, or the value of their underlying portfolios). JRS trades at a 6.8% discount today.

So we can buy its portfolio of top-notch REITs for around 93 cents on the dollar—even though JRS (in purple below) has beaten REITs overall (going by the performance of a popular REIT ETF, in orange) in the last five years.

JRS Beats REITs, Pays 8.4%

That’s impressive, since the benchmark SPDR Dow Jones REIT Index (RWR) yields 3.8%, less than half the income JRS provides! In other words, this fund is beating REITs and “translating” its gains into a strong cash stream.

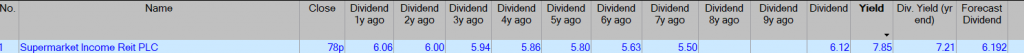

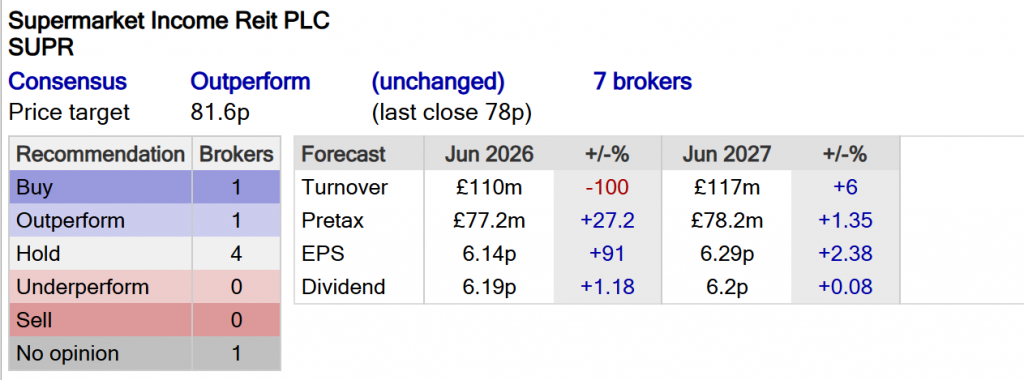

Moreover, the dividend has only fluctuated a bit over the last five years, even with the 2022 interest-rate surge:

JRS Puts Shareholders First as Rates Rise

Source: Income Calendar

This dividend and total-return performance is impressive, as REITs borrow heavily to invest in their properties, and rising rates boost their borrowing costs. Higher rates also draw investors away from REITs and toward “safer” investments like Treasuries.

So why are investors sleeping on JRS? Its small size is part of the reason: With just $241 million in assets, it’s tiny compared to many ETFs (RWR, for example, is over 10 times JRS’s size, with $2.6 billion in assets.

Now let’s move on to JRS’s discount to NAV, because it’s in the “sweet spot.” Sitting at 6.8%, it’s wider than where it was at the start of the year. But it’s been narrowing (with the typical fluctuations you’d expect), giving the fund some “discount momentum.”

JRS’s Sale Ending Soon

This is a setup we love to see: Now that the discount is disappearing, JRS is delivering extra price gains on top of its huge dividend. That should shrink its discount further.

On top of that, JRS’s portfolio is growing in value. Its 92-REIT-strong portfolio is led by top holdings Prologis (PLD), a warehouse giant; data-center landlord Equinix (EQIX); senior-care REIT Ventas (VTR); and office REIT Highwoods Properties (HIW).

So if your real estate exposure is primarily in your home, JRS can help you diversify (and hedge against a pullback in residential real estate).

If you’re not a homeowner, this fund is a great way to gain access to a broad range of real estate—more than your individual homeowner ever could. Either way, you’ll also collect that sweet 8.4%-yielding dividend.

The Independent

The Independent